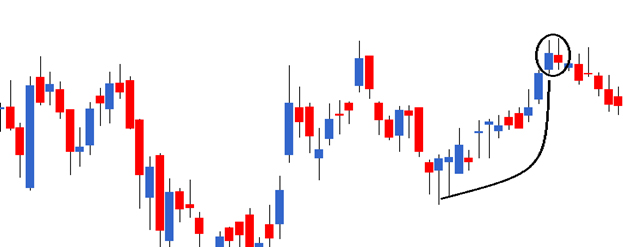

The bearish harami pattern appears at the top end of an uptrend which gives the trader a opportunity to initiate a short trade.

The thought process behind shorting a bearish harami is as follows:

- The market is in an uptrend, placing the bulls in absolute control

- On P1, the market trades higher, and makes a new high and closes positively forming a blue candle day. The trading action reconfirms the bulls dominance in the market

- On P2 the market unexpectedly opens lower which displaces the bulls ,and sets in a bit of panic to bulls

- The market continues to trade lower to an extent where it manages to close negatively forming a red candle day

- The unexpected negative drift in the market causes panic making the bulls to unwind their positions

- The expectation is that this negative drift is likely to continue and therefore one should look at setting up a short trade.

The trade setup for the short trade based on bearish harami is as follows:

- The risk taker will short the market near the close of P2 after ensuring P1 and P2 together forms a bearish harami. To validate this, two conditions must be satisfied:

- The open price on P2 should be lower than the close price of P1

- The close price on P2 should be greater than the open price of P1

- The risk averse will short the market the day after P2 after ensuring it forms a red candle day

- The highest high between P1 and P2 acts as the stoploss for the trade.

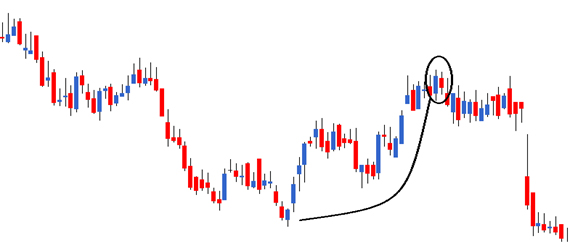

Here is a chart of IDFC Limited where the bearish harami is identified. The OHLC details are as follows:

P1 – Open = 124, High = 129, Low = 122, Close = 127

P2 – Open = 126.9, High = 129.70, Low, = 125, Close = 124.80

P2 – Open = 126.9, High = 129.70, Low, = 125, Close = 124.80

The risk taker will initiate the trade on day 2, near the closing price of 125. The risk averse will initiate the trade on the day after P2, only after ensuring it forms a red candle day. In the above example, the risk averse would have avoided the trade completely.

The stop loss for the trade would be the highest high between P1 and P2. In this case it would be 129.70.

0 Comments