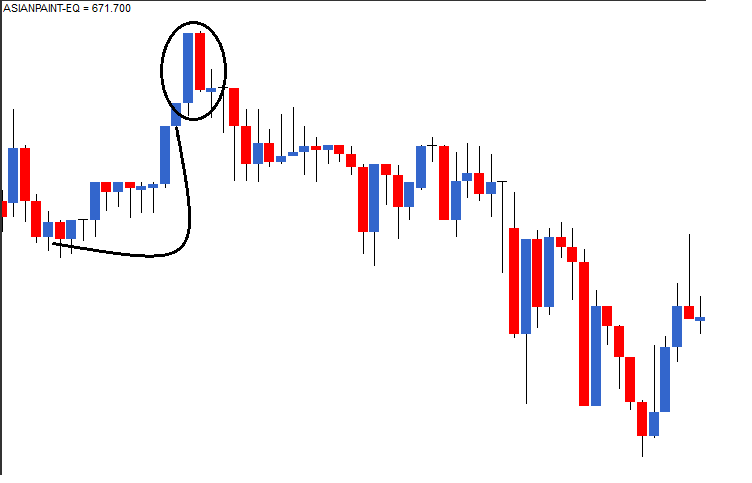

The dark cloud cover is very similar to the bearish engulfing pattern with a minor variation. In a bearish engulfing pattern the red candle on P2 engulfs P1’s blue candle completely. However in a dark cloud cover, the red candle on P2 engulfs about 50 to 100% of P1’s blue candle. The trade set up is exactly the same as the bearish engulfing pattern. Think about the dark cloud cover as the inverse of a piercing pattern.

A perspective on selecting a trade

Typically stocks in the same sector have similar price movement. For example, think about TCS and Infosys or ICICI Bank and HDFC bank. Their price movement is similar because these companies are more or less of the same size, have similar business, and the same external factors that affect their business. However this does not mean their stock price movement would match point to point. For example if there is negative news in the banking sector, banking stocks are bound to fall. In such a scenario if the stock price of ICICI Bank falls by 2%, it is not really necessary that HDFC Bank’s stock price should also fall exactly 2%. Probably HDFC Bank stock price may fall by 1.5% or 2.5%. Hence the two stocks may form 2 different (but somewhat similar) candlestick patterns such as a bearish engulfing and dark cloud cover at the same time.

Both these are recognisable candlestick patterns but if I were to choose between the two patterns to set up a trade. I would put my money on the bearish engulfing pattern as opposed to a dark cloud cover. This is because the bearishness in a bearish engulfing pattern is more pronounced (due to the fact that it engulfs the previous day’s entire candle). On the same lines I would choose a bullish engulfing pattern over a piercing pattern.

However there is an exception to this selection criterion. Later in this module I will introduce a 6 point trading checklist. A trade should satisfy at least 3 to 4 points on this checklist for it to be considered as a qualified trade. Keeping this point in perspective, assume there is a situation where the ICICI Bank stock forms a piercing pattern and the HDFC Bank stock forms a bullish engulfing pattern. Naturally one would be tempted to trade the bullish engulfing pattern, however if the HDFC Bank stock satisfies 3 checklist points, and ICICI Bank stock satisfies 4 checklist points, I would go ahead with the ICICI Bank stock even though it forms a less convincing candlestick pattern.

On the other hand, if both the stocks satisfy 4 checklist points I will go ahead with the HDFC Bank trade.

0 Comments