In a single candlestick pattern, the trader needed just one candlestick to identify a trading opportunity. However when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. This means the trading opportunity evolves over a minimum of 2 trading sessions.

The engulfing pattern is the first multiple candlestick pattern that we need to look into. The engulfing pattern needs 2 trading sessions to evolve. In a typical engulfing pattern, you will find a small candle on day 1 and a relatively long candle on day 2 which appears as if it engulfs the candle on day 1. If the engulfing pattern appears at the bottom of the trend, it is called the “Bullish Engulfing” pattern. If the engulfing pattern appears at the top end of the trend, it is called the “Bearish Engulfing” pattern.

The Bullish Engulfing Pattern

The bullish engulfing pattern is a two candlestick pattern which appears at the bottom of the down trend. As the name suggests, this is a bullish pattern which prompts the trader to go long. The two day bullish engulfing pattern is encircled in the chart below. The prerequisites for the pattern are as follows:

- The prior trend should be a downtrend

- The first day of the pattern (P1) should be a red candle reconfirming the bearishness in the market

- The candle on the 2nd day of pattern (P2) should be a blue candle, long enough to engulf the red candle

The thought process behind the bullish engulfing pattern is as follows:

- The market is in down trend with prices steadily moving down

- On the first day of the pattern (P1), the market opens low and makes a new low. This forms a red candle in the process

- On the second day of the pattern (P2), the stock opens near the closing prices of P1, and attempts to make a new low. However, at this low point of the day there is a sudden buying interest, which drives the prices to close higher than the previous day’s open. This price action forms a blue candle

- The price action on P2 also suggests that bulls made a very sudden and strong attempt to break the bearish trend and they did so quite successfully. This is evident by the long blue candle on P2

- The bears would not have expected the bull’s sudden action on P2 and hence the bull’s action kind of rattles the bears causing them some amount of nervousness

- The bullishness is expected to continue over the next few successive trading sessions, driving the prices higher and hence the trader should look for buying opportunities

The trade set up for the bullish engulfing pattern is as follows:

- The bullish engulfing pattern evolves over two days

- The suggested buy price is around the close price of blue candle i.e on P2

- Risk taker initiates the trade on P2 itself after ensuring P2 is engulfing P1

- The risk averse initiates the trade on the next day i.e the day after P2 around the closing price, after confirming the day is forming a blue candle

- If the day after P2 is a red candle day, the risk averse trader will ignore the trade, owing to rule 1 of candlesticks (Buy strength and Sell weakness)

- On a personal note, in multiple candlestick patterns where the trade evolves over 2 or more days it is worth to be a risk taker as opposed to a risk averse trader

- The stop loss for the trade would be at the lowest low between P1, and P2

Needless to say, once the trade has been initiated you will have to wait until the target has been hit or the stoploss has been breached. Of course, one can always trail the stop loss to lock in profits.

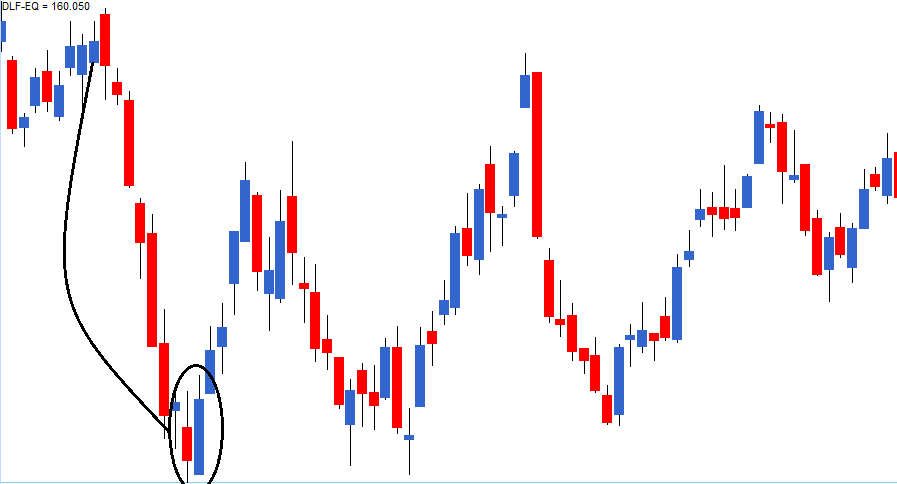

Have a look at DLF’s chart below; the bullish engulfing pattern is encircled.

The OHLC on P1 – Open = 163, High = 168, Low = 158.5, Close = 160. On P2 the OHLC details are – Open = 159.5, High = 170.2, Low = 159, Close = 169.

The trade set up for the bullish engulfing pattern is as follows:

- The risk taker would go long on P2 at 169. He can do this by validating P2 as an engulfing pattern. To validate P2 as an engulfing patterns there are 2 conditions:

- One, the current market price at 3:20PM on P2 should be higher than P1’s open.

- Second, the open on P2 should be equal to or lower than P1’s close

- The risk averse will initiate the trade, the day after P2 only after ensuring that the day is a blue candle day. So if the P1 falls on a Monday, the risk averse would be initiating the trade on Wednesday, around 3:20 PM. However, as I had mentioned earlier, while trading based on multiple candlestick pattern, it may be worth initiating the trade on pattern completion day itself i.e P2

- The stop loss on this trade will be the lowest low between P1 and P2. In this example, lowest low falls on P1 at 158.5

In this example, both the risk averse and the risk taker would have been profitable.

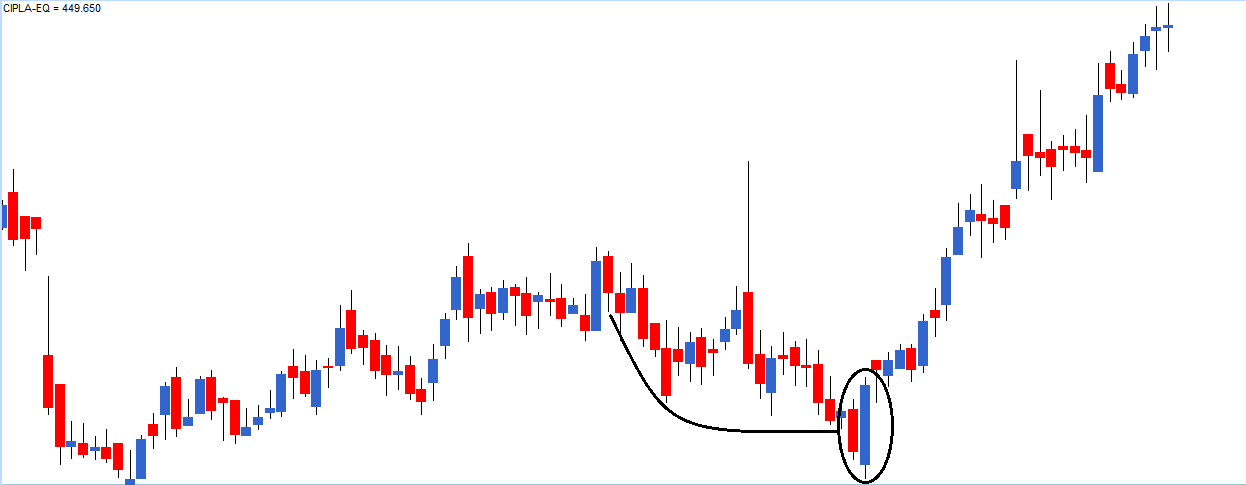

Here is an example of a perfect bullish engulfing pattern formed on Cipla Ltd, the risk averse trader would have completely missed out a great trading opportunity.

There is often a lot of confusion on whether the candle should engulf just the real body or the whole candle, including the lower and upper shadows. In my personal experience, as long as the real bodies are engulfed, I would be happy to classify the candle as a bullish engulfing pattern. Of course, candlestick sticklers would object to this but what really matters is how well you hone your skills in trading with a particular candlestick pattern.

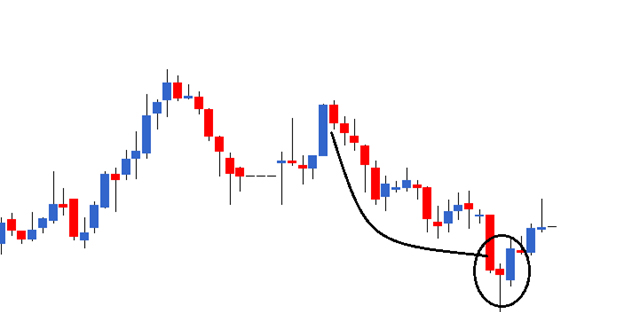

So going by that thought, I’d be happy to classify the following pattern as a bullish engulfing pattern, even though the shadows are not engulfed.

0 Comments