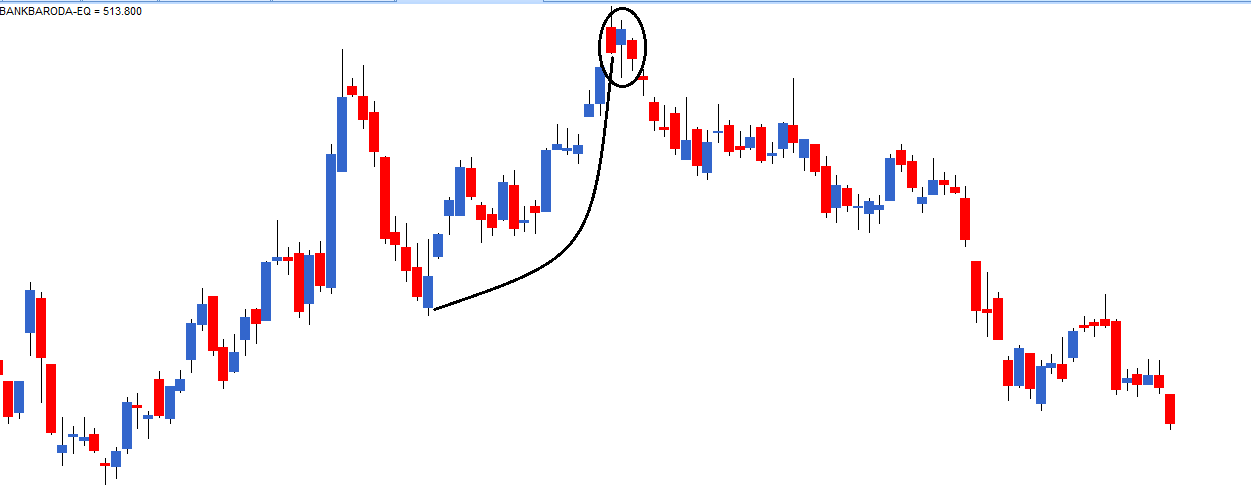

If a paper umbrella appears at the top end of a trend, it is called a Hanging man. The bearish hanging man is a single candlestick, and a top reversal pattern. A hanging man signals a market high. The hanging man is classified as a hanging man only if is preceded by an uptrend. Since the hanging man is seen after a high, the bearish hanging man pattern signals selling pressure.

A hanging man can be of any color and it does not really matter as long as it qualifies ‘the shadow to real body’ ratio. The prior trend for the hanging man should be an uptrend, as highlighted by the curved line in the chart above. The thought process behind a hanging man is as follows:

- The market is in an uptrend, hence the bulls are in absolute control

- The market is characterized by new highs and higher lows

- The day the hanging man pattern appears, the bears have managed to make an entry

- This is emphasized by a long lower shadow of the hanging man

- The entry of bears signifies that they are trying to break the strong hold of the bulls

Thus, the hanging man makes a case for shorting the stock. The trade set up would be as follows:

- For the risk taker, a short trade can be initiated the same day around the closing price

- For the risk averse, a short trade can be initiated at the close of the next day after ensuring that a red candle would appear

- The method to validate the candle for the risk averse, and risk taker is exactly the same as explained in the case of a hammer pattern

Once the short has been initiated, the high of the candle works as a stoploss for the trade.

In the chart above, BPCL Limited has formed a hanging man at 593. The OHLC details are –

Open = 592, High = 593.75, Low = 587, Close = 593. Based on this, the trade set up would be as follows:

- The risk taker, initiates the short trade on the day the pattern appears (at 593)

- The risk averse, initiates the short trade on the next day at closing prices after ensuring it is a red candle day

- Both the risk taker and the risk averse would have initiated their respective trades

- The stoploss price for this trade would be the high price i.e above 593.75

The trade would have been profitable for both the risk types.

My experience with a paper umbrella

While both the hammer and the hanging man are valid candlestick patterns, my dependence on a hammer is a little more as opposed to a hanging man. All else equal, if there were two trading opportunities in the market, one based on hammer and the other based on hanging man I would prefer to place my money on hammer. The reason to do so is simply based on my experience in trading with both the patterns.

My only concern with a hanging man is the fact that if the bears were indeed influential during the day, why did the price go up after making a low? This according to me re establishes the bull’s supremacy in the market.

I would encourage you to develop your own thesis based on observations that you make in the markets. This will not only help you calibrate your trade more accurately but also help you develop structured market thinking.

0 Comments